Your current location is:Fxscam News > Platform Inquiries

Oil prices are fluctuating, enhancing the safe

Fxscam News2025-07-22 21:47:08【Platform Inquiries】4People have watched

IntroductionHow to choose Forex brokers,Yide Sports real-person registration and account opening safety 45yb point in,On Friday (May 31), during the Asian trading session, crude oil prices continued to fall, possibly m

On Friday (May 31),How to choose Forex brokers during the Asian trading session, crude oil prices continued to fall, possibly marking the second consecutive week of decline. The main drag was the uncertainty sparked by U.S. President Trump's tariff policies, which raised market concerns about a global economic slowdown and reduced energy demand. As the crude oil market faced pressure, the safe-haven qualities of gold became increasingly prominent, and its price is expected to continue receiving support.

I. Falling Oil Prices, Rising Market Risk Aversion

Brent crude futures for August delivery were priced at $63.89 per barrel, down 0.4%, while WTI crude was at $60.66 per barrel, down 0.5%. The weekly cumulative decline exceeded 1%, reflecting investors' deep concerns about the prospects for energy market demand. Although U.S. crude inventories unexpectedly dropped by 2.8 million barrels, temporarily easing the pressure, overall market sentiment remains bearish.

While the energy sector faced turbulence, the gold market quietly heated up. Driven by risk aversion, funds moved out of high-risk commodities like crude oil, with some shifting towards defensive assets such as gold.

II. Legal Tug-of-War over Tariff Policies, Boosting Gold's Safe-Haven Demand

The current wave of risk aversion is mainly driven by Trump's legal standoff over reciprocal tariff policies. On Thursday, U.S. Federal Trade Court's ruling to block Trump's reciprocal tariffs temporarily stabilized the market. However, the ruling quickly faced an appeal, and the Supreme Court may intervene, making the policy outlook even more uncertain.

Meanwhile, U.S. Treasury Secretary Besen Tat acknowledged that trade talks with China were "stalling," further dampening market risk appetite and attracting safe-haven funds back to gold. Against the backdrop of pressure on global economic growth and rising policy uncertainty, gold's value-preserving attributes are being re-evaluated.

III. OPEC+ Meeting Approaching, Oil Market Watches as Gold Remains Steady

Another focal point for the market is the upcoming OPEC+ meeting this Saturday. The organization will assess whether to adjust production from July. With the prior stance of maintaining production quotas unchanged, expectations for increased production have clearly cooled. However, Kazakhstan's refusal to comply with production cut requests complicates internal coordination. If the OPEC+ meeting delivers conservative signals, oil prices might gain temporary support, but ongoing uncertainty could still drive the market to seek safe havens, indirectly benefiting gold.

Conclusion:

Currently, the crude oil market is weak due to the fluctuations in Trump's tariff policies and the uncertainty of the OPEC+ meeting. With rising investor demand for safe havens, gold has once again taken center stage in the market. If trade tensions escalate and global economic pressures persist, gold is likely to receive further support. In the short term, gold prices may continue to fluctuate at high levels, with the market keenly monitoring Fed statements, trade negotiation developments, and the performance of risk assets. Gold is quietly becoming the core of another safe-haven cycle.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(88)

Related articles

- The Spanish National Securities Market Commission (CNMV) warns four unregistered entities.

- Positive salary data suggests the Bank of Japan may raise interest rates.

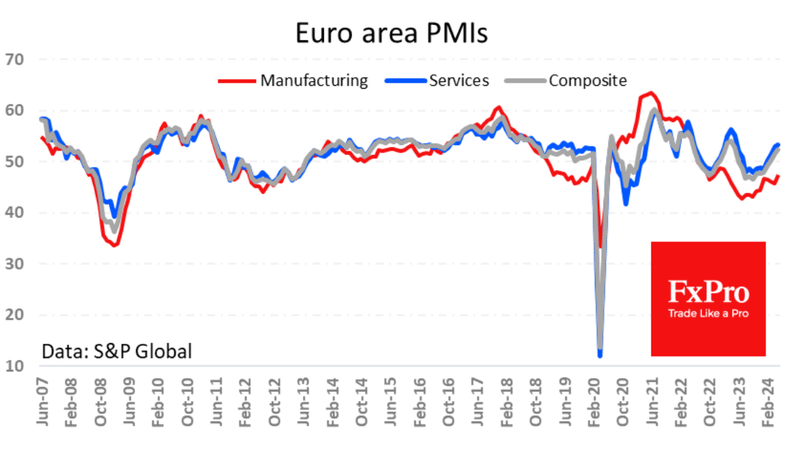

- Japan’s October service PMI fell below 50, indicating slower recovery.

- Besent denies clash with Musk, says they share goals but differ in style, no physical altercation oc

- Goldmans Global Review: High Risk (Suspected Fraud)

- Trump's statement triggers a chain reaction in the market.

- The market is buying the dip in gold, likely pushing prices past $3,000.

- The Reserve Bank of New Zealand holds rates steady, may cut in the future.

- MEFIC Capital is a scam: Avoid at all costs

- Trump left the G7 early and ordered the National Security Council's situation room to stand by.

Popular Articles

- Compensation Plan for the Transaction Issue on Live 03 in the China Region

- The US bond market has lagged for four years amid eroding investor confidence.

- Tensions in Iran may disrupt key Mideast waterways, heightening risks for shipping and oil transport

- Argentina relaxed currency controls, but agricultural sales have been slow to respond.

Webmaster recommended

X to Relaunch Political Advertising in the US, Gearing up for the 2024 Presidential Election

U.S. Treasury yields decline, sparking market concerns over economic stagnation.

"Mr. Yen" expects that the Bank of Japan will not intervene in the exchange rate.

What is Overnight Interest? Five Common Questions about Overnight Interest

Blue Suisse Review: Regulated

CBO: Tariffs Imposed by Trump Could Harm U.S. Economy

Pentagon intel contradicts Trump, leaving Iranian nuclear facility damage uncertain

Trump says "no need" to extend tariff deadlines, pressuring nations to reach deals swiftly